Published March 27, 2012, Dow Jones Newswires – In a rare display of bipartisanship, the House passed a bill Tuesday aimed at boosting jobs by easing an array of business regulations, the measure’s last step before it can be signed by the president.

House passed a bill Tuesday aimed at boosting jobs by easing an array of business regulations, the measure’s last step before it can be signed by the president.

The vote was 380-41.

Backed by the Obama administration and the Democrat-controlled Senate, the bill reflects a desire by both parties during an election year to show they are doing all they can to eliminate red-tape for startups and small businesses.

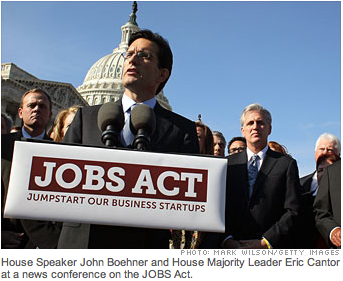

But regulators, investor groups and a small number of Democrats have charged that the Jumpstart Our Business Startups, or JOBS act, is unlikely to succeed in boosting employment and would likely lead to more financial fraud.

Specifically, the bill eases corporate governance and financial reporting requirements for initial public offerings, while also loosening a variety of other rules designed to make it easier for private companies to raise capital without an IPO.

Newly public companies with annual revenues of as much as $1 billion — a threshold that covers the bulk of recent IPOs — would be excused from new or revised national accounting and auditing standards and wouldn’t have to hire an auditor to make sure systems are up to snuff for up to five years.

The bill also would allow research analysts to write reports about companies just before an IPO even if bankers at their firm are underwriting the offering, which currently isn’t allowed. The rules were put in place to prevent investment bankers from promising potential clients favorable research in return for underwriting assignments.

The changes represent one of the biggest rollbacks of the 2002 Sarbanes-Oxley law, the revamp of accounting rules enacted in response to the Enron and WorldCom scandals, and the first major slackening of securities laws since the Dodd-Frank financial overhaul.

The House had already signed off on an earlier version of the jobs bill earlier this month, by a vote of 390-23, but had to vote on it again after the Senate amended the bill. The Senate’s additions are aimed at protecting investors in start-ups that use so-called crowdfunding techniques, in which entrepreneurs tap thousands of investors who are given very small shares of stock.

Specifically, the Senate changes would require more thorough disclosure to investors of crowdfunding initiatives — including the risks of such investments — as well as scaled annual limitations on the overall amount of money individuals can invest in such startups based on their income. The SEC also would oversee crowdfunding websites that function as “funding portals” for such startups.

The bill also would make it easier for startups to pitch investments to wealthy individuals and would quadruple to 2,000 the number of shareholders closely held companies and community banks can have before they must open their books to the Securities & Exchange Commission.